The $80 billion SEO industry just got disrupted by something it never saw coming: intelligence itself.

For two decades, the playbook was simple. Stuff keywords, build backlinks, optimize for Google’s algorithm, and watch the traffic flow. Entire agencies, careers, and fortunes were built on gaming page rank. But in 2025, something fundamental shifted. Search moved from browsers to brains—artificial ones.

Apple integrated Perplexity and Claude into Safari. ChatGPT started driving 10% of Vercel’s new signups. People began asking 23-word questions instead of 4-word searches. The game changed overnight.

Welcome to Generative Engine Optimization (GEO)—where visibility isn’t about ranking first on a results page, but being remembered by the model itself. a16z: How Generative Engine Optimization (GEO) Rewrites the Rules of Search

The Collapse of the Link Economy

Traditional SEO was built on a fiction: that relevance could be measured by counting connections. Google’s PageRank algorithm treated the web like a popularity contest, assuming that the most-linked content was the most valuable. This spawned an entire shadow economy of link farms, content mills, and keyword optimization strategies. But backlinks now contribute 30% less to rankings in AI-generated responses, as LLMs prioritize contextual relevance over link popularity.

LLMs don’t crawl links—they synthesize meaning. They don’t rank pages—they generate responses. In 2025, over 30% of searches use conversational interfaces, with AI queries averaging 10-11 words versus Google’s 2-3, demanding content optimized for natural language. The shift from retrieval to reasoning breaks every assumption that powered the SEO industrial complex.

Consider the structural differences:

SEO Era: 4-word queries → 10 blue links → click-through rates GEO Era: 23-word conversations → direct synthesis → reference rates

The metric that matters isn’t whether you appear in search results—it’s whether you’re cited in the answer. This isn’t a marginal improvement in search; it’s a fundamental reorganization of how information flows from source to consumer.

The Reference Economy

In the GEO world, brands don’t optimize for clicks—they optimize for citations. The question isn’t “Will users find you?” but “Will the model remember you?” GEO strategies can increase visibility in AI responses by up to 40%, with lower-ranked sites gaining as much as 115.1% through tactics like authoritative source citation.

This creates an entirely new competitive dynamic. Canada Goose, for instance, now tracks not just whether people search for winter coats, but whether AI models spontaneously mention their brand when asked about warmth, quality, or luxury outerwear. This is unaided awareness in the age of artificial intelligence.

The implications are profound:

Visibility becomes contextual: Your brand’s value isn’t determined by search volume, but by semantic association

Memory becomes monopoly: Models that remember you correctly have more influence than pages that rank you highly

Context beats keywords: Dense, well-structured content matters more than keyword density

The Platform Opportunity Hidden in Plain Sight

Here’s where it gets interesting for investors and founders: GEO isn’t just a new marketing discipline—it’s a platform play disguised as a tooling shift. With Google, Bing, and OpenAI investing over $10 billion in AI search by 2025, GEO platforms are poised to capture a slice of an $80 billion market.

SEO was always fragmented. Tools like Ahrefs, SEMrush, and Moz carved out niches but never owned the full stack. They were data providers, not platforms. The core limitation? They could observe Google’s algorithm but never influence it.

GEO changes that equation entirely.

The most compelling GEO companies won’t just measure brand mentions across LLM outputs. They’ll fine-tune their own models, learning from billions of implicit prompts across verticals. They’ll own the feedback loop: insight → optimization → measurement → iteration.

This is the monopolistic opportunity that SEO never offered. Instead of analyzing someone else’s algorithm, you’re building your own intelligence layer. Instead of inferring rankings from external signals, you’re directly shaping how models perceive and reference brands.

The Infrastructure Play

The real opportunity isn’t in brand monitoring—it’s in becoming the system of record for AI-brand interaction.

Consider the stack:

Measurement Layer: Track brand perception across models

Optimization Engine: Generate content optimized for model memory

Feedback Loop: Real-time iteration based on LLM behavior shifts

Distribution Network: API-driven integration into brand workflows

This isn’t tooling. This is infrastructure. And unlike the fragmented SEO market, the winners in GEO will likely consolidate around platforms that can execute across the full stack.

Why This Time Is Different

Three structural factors suggest GEO will evolve differently than SEO:

1. Models vs. Algorithms: You can fine-tune a model. You can’t fine-tune Google’s PageRank.

2. Subscription vs. Advertising: LLMs are primarily subscription-driven, changing the incentive structure around content discovery and monetization.

3. Synthesis vs. Retrieval: Models don’t just find content—they transform it. This creates new leverage points for optimization that didn’t exist in the link economy.

The business model implications are significant. While SEO was always adjacent to performance marketing, GEO can be central to it. The same brand guidelines and user understanding that power model optimization can drive growth marketing across channels.

The Autonomous Marketing Horizon

This is where the story gets larger than search optimization. As models become more sophisticated at understanding context, brands, and user intent, we’re approaching something that looks like autonomous marketing—systems that can test, iterate, and optimize across channels without human intervention. By 2026, 55% of searches will be AI-driven, with 45% voice-based by 2027, and Google Lens processing 20 billion visual searches monthly, demanding multimodal GEO strategies.

GEO is the wedge. The real opportunity is building the intelligence layer that orchestrates brand interaction across the entire digital ecosystem.

The Reference Wars Begin

We’re entering a new competitive era where brands don’t fight for attention—they fight for memory. Businesses relying solely on SEO face 20-40% organic traffic losses due to AI search, with e-commerce sites seeing a 22% drop from AI-driven suggestions. The companies that win won’t just be visible in search results; they’ll be embedded in the model’s understanding of their category, their value proposition, and their differentiation.

This is the reference wars: the competition to get into the model’s mind.

The GEO Market Landscape

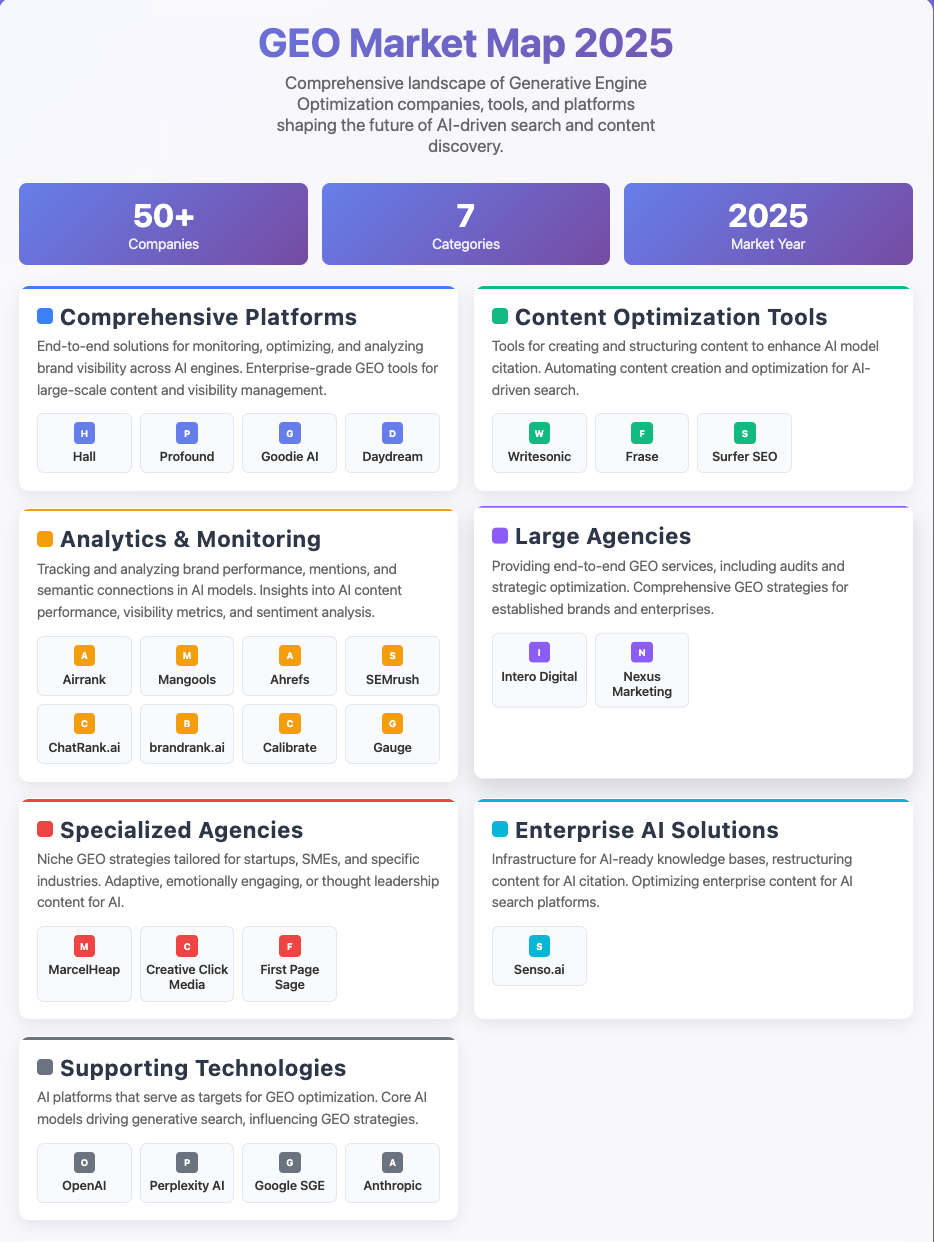

The shift to GEO has spurred a new ecosystem of tools, agencies, and platforms designed to optimize brand visibility in AI-driven search. In 2025, 75% of digital agencies have launched GEO services, with 63% of marketers prioritizing GEO, signaling a maturing ecosystem. Below is a market map of key players shaping this space, offering solutions from content optimization to analytics and full-stack infrastructure.

This landscape highlights the diversity of the GEO ecosystem, from startups like Senso.ai and Goodie AI building innovative tools, to established players like Ahrefs and SEMrush adapting to AI-driven search. For investors, these emerging platforms represent high-growth opportunities in a fragmented market.

The question for every brand, founder, and investor is simple: When intelligence becomes the interface, will you be remembered?

This shift represents more than a tactical marketing evolution—it’s a structural transformation in how information, brands, and commerce intersect with artificial intelligence. The winners won’t just adapt to this change; they’ll build the infrastructure that defines it.